EB-5 Regional Center Compliance & Sponsorship Solutions

We assist regional centers in meeting their compliance obligations under the EB-5 Reform & Integrity Act of 2022 (RIA) by working directly with their sponsored new commercial enterprises (NCEs) to gather, review, and organize all required documentation.

This ensures that the regional center can accurately certify compliance when filing the I-956G annual report and remain in good standing with USCIS. Our process helps mitigate risks associated with USCIS audits by ensuring that all regulatory requirements are met and properly documented.

Failure to maintain compliance can put your regional center at risk of termination, impacting all sponsored petitioners. Our outsourced compliance service ensures due diligence and regulatory adherence, mitigating these risks and maintaining investor confidence.

Regional Centers

At EB5Marketplace.com, we receive weekly inquiries from EB-5 developers looking for reputable regional center sponsors for their projects. If your regional center is open to sponsorship opportunities, we can introduce you to projects that align with your geographic designation.

- Receive pre-vetted project referrals looking for a regional center sponsor.

- Leverage our compliance team to streamline sponsorship responsibilities while maintaining full compliance.

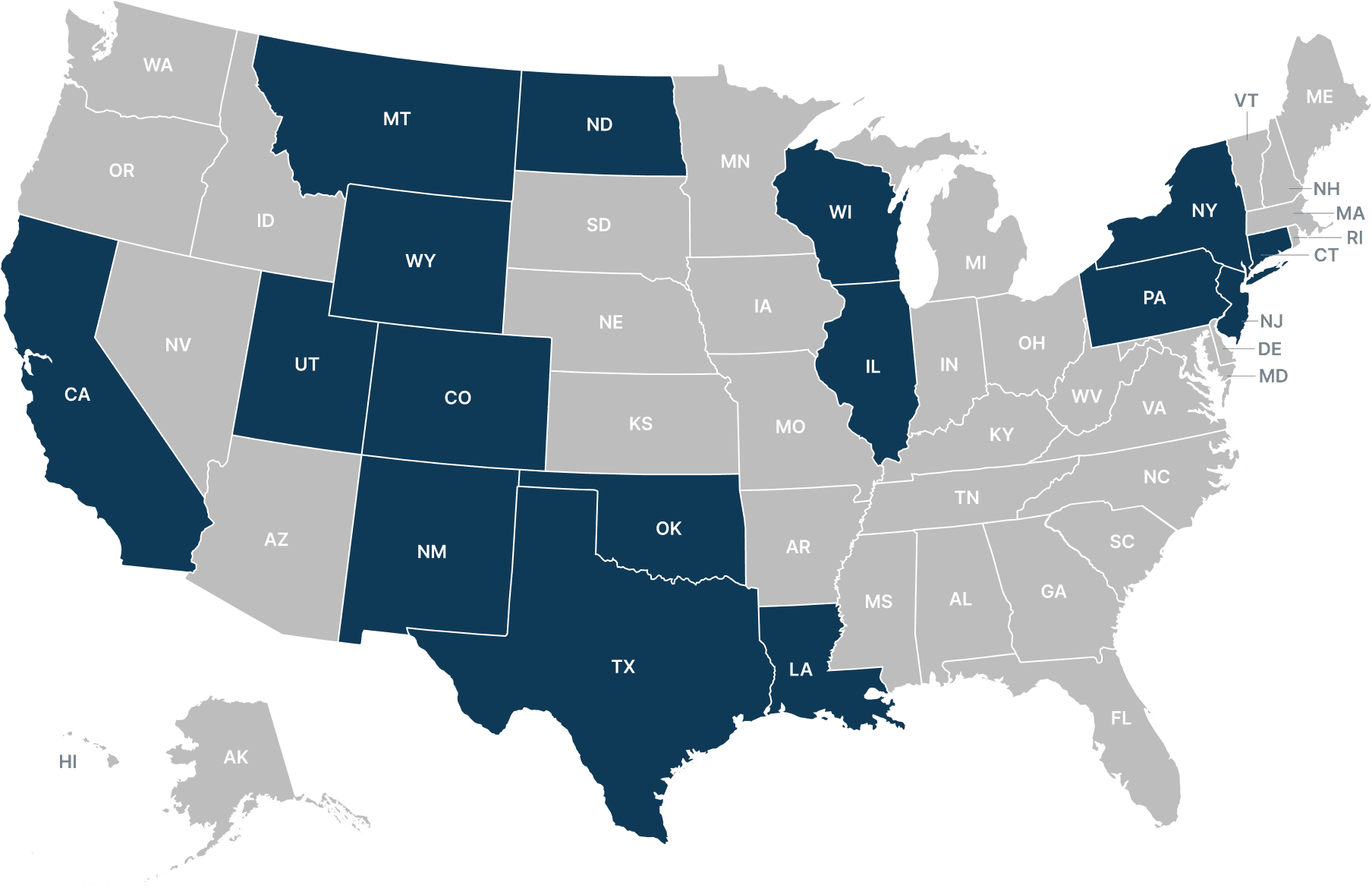

Regional Center Coverage Map

We provide compliance and sponsorship coverage in the following states

We provide compliance and sponsorship coverage in the following states

“They understand the proper relationship between immigration and securities law and economic job creation models to properly advise their clients.”

Due Diligence and Compliance Review

We conduct an in-depth review to ensure compliance with both RIA and SEC regulations, including:

- Offering Documents Review: Verifying claims, assessing feasibility, and evaluating risks.

- Background Checks: On NCE and JCE management.

Investor & Agent Compliance

- Investor Forms Review: Evaluation questionnaires and fee disclosures.

- Investor Background KYC and OFAC screening to ensure compliance.

- Agent Agreements & I-956K Filings: Ensuring agents meet EB-5 regulatory filing requirements.

Annual Compliance Support for Regional Centers

We provide ongoing compliance support to ensure your regional center remains in good standing:

Prepare and file the I-956G Annual Report.

Verify investor documentation and address deficiencies.

Monitor project progress: Job creation, funds raised, and spent.

Review and Maintain Regulatory filings (I-956K agent agreements.

Assist with USCIS audit preparation.

“Having proper policies and procedures in place is one thing, but having expertise and discipline to implement those policies in every transaction involving numerous parties is quite another.

Retaining an EB-5 savvy and SEC registered broker-dealer to confirm proper policies and to oversee actual compliance would be a wise move for most regional centers and new commercial enterprises.”

Pricing & Fee Structure

Our Regional Center Compliance & Sponsorship Services operate under a straightforward fee structure that covers:

- Due Diligence Fee – A one-time fee for reviewing the project, offering documents, investor oversight, and regional center compliance requirements.

- Annual Compliance Fee – Covers investor verification, regulatory filings, and I-956G annual reporting to ensure the regional center remains in good standing.

- Sponsorship Fees – If you’re open to sponsoring an EB-5 project, we work with projects to structure a fair sponsorship arrangement, ensuring both the regional center and compliance team are compensated appropriately.

Contact Us for a Compliance Discussion

Ensure your regional center remains compliant. Schedule a consultation with our experts today.